Hidden Forex Costs Traders Ignore (But Lose Money On)

Forex trading isn’t just about entries and exits — every trade has invisible costs. These small charges add up and can turn profitable traders into losing traders if they don’t understand them. Let’s break down the hidden costs that every trader must know.

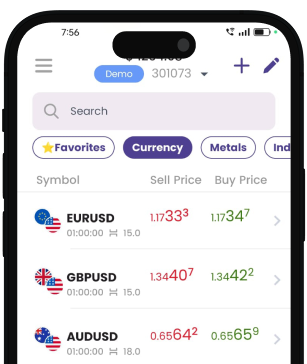

🔹 1. Spread — The Cost You Pay Before the Trade Even Starts

What is Spread?

Spread is the difference between the buy (ask) and sell (bid) price.

This means the moment you enter a trade, you start with a small loss.

Example:

Buy: 1.1050

Sell: 1.1048

Spread = 2 pips

→ Instantly –2 pips loss.

Why It Matters:

-

Higher spreads = higher cost

-

Spreads widen during news

-

Exotic pairs have big spreads

Smart Tip:

Stick to major pairs during liquid sessions.

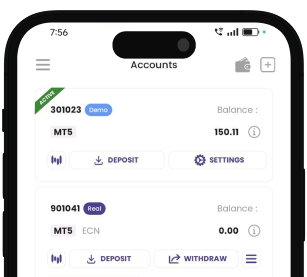

🔹 2. Commission — The Fee You Pay Per Trade

What is Commission?

Some brokers charge a fixed fee per lot, especially on ECN or Raw Spread accounts.

Example:

$7 per lot (round trip)

0.10 lot trade = $0.70 commission

Why It Matters:

Scalpers and day traders open many trades — costs add up fast.

Smart Tip:

Choose low-commission accounts for small timeframes.

🔹 3. Slippage — When You Get a Different Price Than You Clicked

What is Slippage?

Your trade opens/closes at a different price due to fast movement.

Example:

You click buy at 1.2000

Order fills at 1.2003 → 3 pips extra loss

When It Happens:

-

High volatility

-

News

-

Market gaps

-

Low liquidity

Smart Tip:

Avoid major news if you don’t want slippage.

🔹 4. Swap — The Overnight Interest Fee

What is Swap?

Interest charged or paid when you keep a trade overnight.

You may get:

✔ Positive Swap (broker pays you)

✘ Negative Swap (broker charges you)

Example:

Holding a sell on XAUUSD → –$4 per day

10 days = –$40 just in swap

Smart Tip:

Always check the broker's swap table before planning long-term trades.

🔹 5. Swap-Free Accounts — “Free” But Not Always Cheap

Traders think swap-free = zero cost.

But brokers often add hidden charges.

How Swap-Free Accounts Work:

-

No overnight swap

BUT -

Admin fee after a few days

-

Higher spreads

-

Not all pairs allowed

Example:

Normal swap: –$2/day

Swap-free admin fee: –$6 after 3 days

→ Can be more expensive!

Smart Tip:

Good for religious reasons, but not always financially cheaper.

Final Thoughts

These hidden costs seem small, but they add up fast.

By understanding spreads, commissions, slippage, swap, and swap-free charges, traders can protect their profits and trade smarter.

Daily Articles

View More

Best Forex Trading Strategies That Actually Work in 2025

Dec 15, 2025

Why Most Retail Traders Lose Money in Forex (And How to Avoid It)

Dec 13, 2025

Forex Liquidity Explained: Why Price Hunts Stop Losses

Dec 13, 2025

How Algorithmic Trading Is Changing the Forex Market

Dec 13, 2025

How to Read Forex Market Depth Like a Pro

Dec 10, 2025

Mastering Risk Management for High-Volatility Forex Pairs

Dec 10, 2025