>

>

How Swap Rates Affect Your Forex Profits: A Guide for Pipze Traders

Forex trading is not only about price movements—interest rate differences also play a major role. When you hold a position overnight, the broker either credits or charges interest, known as the swap rate. Understanding this is essential for all Pipze traders.

🔹 What Are Swap Rates in Forex?

Swap rate is the interest fee applied when a forex trade is held overnight.

Depending on the interest rate difference between currencies, the trader may receive:

-

Positive Swap – the broker credits interest

-

Negative Swap – the broker charges interest

Swaps depend on:

-

The interest rates of both currencies

-

Whether the position is long (buy) or short (sell)

-

Broker policies

Example:

If you buy a currency with a higher interest rate and sell one with a lower rate, you may receive a positive swap.

🔹 Why Swap Rates Matter

Swaps can significantly influence long-term trading performance.

✔ Daily Passive Income

Positive swaps can generate daily profit even if the price stays stable.

✔ Long-Term Opportunities

Position traders can earn additional income by holding trades for days, weeks, or months.

✔ Risk Management Factor

Negative swaps can reduce profitability if the position is kept open for too long.

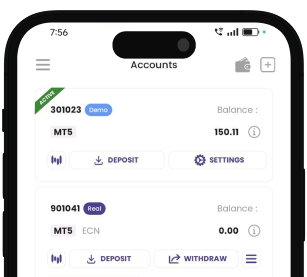

Pipze provides transparent swap information so traders can plan ahead.

🔹 How Pipze Calculates Swap

Pipze uses this standard formula:

Swap = (Position Size × Swap Rate × Days Held) / 10

On Wednesdays, traders are charged or credited triple swap to adjust for the weekend.

🔹 Factors That Influence Swap Rates

-

Central bank interest rate decisions

-

Global market conditions

-

Type of currency pair (major, minor, exotic)

-

Broker-specific swap policies

Example:

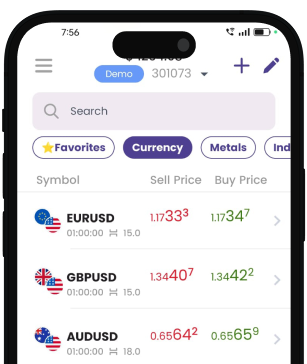

Pairs like AUD/JPY often offer higher positive swaps because of interest rate differences.

🔹 How Pipze Traders Can Benefit from Swaps

-

Check Pipze’s swap table before entering long-term trades

-

Avoid long-term positions with high negative swaps

-

Use high-yield currency pairs for carry trade strategies

-

Be careful with leverage—swap impact increases with position size

Final Thoughts

Swap rates are an essential yet often overlooked part of forex trading. With Pipze’s transparent swap structure, traders can make smarter decisions and optimize long-term profitability. Whether you trade short-term or hold positions for weeks, understanding swaps can give you a strategic advantage.

Daily Articles

View More >

>

XAUUSD Technical Analysis: Where Gold May Move Next?

Dec 03, 2025 >

>

XAUUSD 5-Minute Analysis: Price Reaction Around Intraday Liquidity Zones

Dec 03, 2025