Introduction

Many forex traders spend years searching for the perfect strategy, indicator, or signal. However, the real reason most traders fail is not technical—it is psychological.

Forex trading psychology plays a crucial role in how traders handle losses, manage profits, and follow rules. In reality, traders do not lose money because of the market; they lose money because of their own emotions.

What Is Forex Trading Psychology?

Forex trading psychology refers to the emotional and mental state that influences a trader’s decisions. It includes:

-

How you react to losses

-

How you behave after making profits

-

Whether you follow your trading plan or act emotionally

The market itself is neutral. Fear, greed, and impatience exist only within the trader.

Common Psychological Mistakes Forex Traders Make

1. Fear

Fear causes traders to:

-

Exit trades too early

-

Miss good trading opportunities

-

Close positions before the setup is complete

Fear usually comes from risking too much capital on a single trade.

2. Greed

Greed pushes traders to:

-

Use oversized lot sizes

-

Ignore targets and hold trades too long

-

Overtrade to make quick money

Greed often leads to overconfidence and unnecessary losses.

3. Revenge Trading

After a loss, some traders immediately enter new trades to recover money.

This emotional reaction is known as revenge trading and is one of the fastest ways to blow an account.

4. Overconfidence

A series of winning trades can create a false sense of control. Traders may:

-

Stop using stop-losses

-

Break their own rules

-

Believe the market will always move in their favor

The market does not reward ego.

Why Traders Lose Even with a Good Strategy

Many traders use profitable strategies but still fail because:

-

They do not follow rules consistently

-

They ignore risk management

-

They let emotions control decisions

Two traders can use the same strategy and get completely different results. The difference is psychology.

How to Build Strong Forex Trading Psychology

1. Control Risk on Every Trade

Never risk more than 1–2% of your capital per trade.

Accept losses as part of the trading business, not as personal failures.

2. Follow a Written Trading Plan

Your plan should clearly define:

-

Entry rules

-

Stop-loss placement

-

Take-profit targets

-

Maximum daily loss

Trading without a plan is gambling.

3. Maintain a Trading Journal

Record:

-

Why you took the trade

-

Your emotional state

-

The final outcome

A journal helps you identify emotional patterns and mistakes.

4. Accept Losses Professionally

Losses are unavoidable in forex trading.

Even professional traders win only 50–60% of their trades. Consistency matters more than perfection.

5. Develop Patience

Forex trading is a long-term game, not a shortcut to instant wealth.

Focus on steady improvement and disciplined execution rather than daily profits.

Golden Rules for Beginner Forex Traders

-

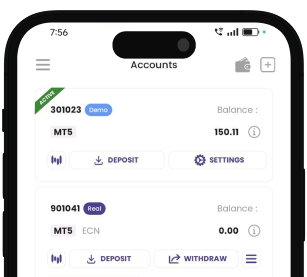

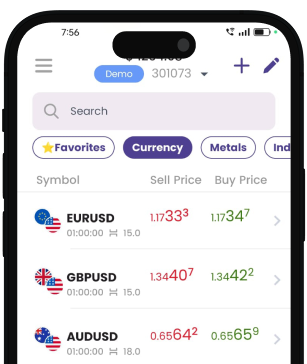

Practice on a demo account first

-

Start with small capital

-

Avoid trading during high-impact news without experience

-

Do not depend on signals blindly

-

Master one strategy before trying another

Final Thoughts

In forex trading:

-

Strategy helps you enter trades

-

Risk management keeps you in the game

-

Psychology determines long-term success

When you learn to control your emotions, the market no longer feels unpredictable.

Master your mindset, and consistent profits will follow. Stay connected with Pipze, for more knowledge regarding Forex Market.

Weekly Articles

View More

The European Union–India Free Trade Agreement: A Game-Changer for Forex Trading

Jan 27, 2026